Have you ever paused to consider what lies beneath the often-cited surface of investment returns? In the symphony of stats and market banter, we’re often entertained with tales of how mutual funds outperform the benchmark over certain periods. However, you will discover a different tune when you peel back the layers and look at how taxes play a nuanced and imperative part in shaping ‘real’ returns. Let’s review the often overlooked ‘after-tax effect’ on index and active funds’ returns. We’ll draw from data and insights to reveal why understanding the after-tax impact is not just prudent; it’s becoming a prerequisite for savvy, long-term investors.

TLDR

In essence, your financial journey culminates not with the gross numbers flaunted by active funds but with the figures that find their way to your pocket post-tax. When it comes to elevating your after-tax investment returns, index funds frequently outshine their active counterparts.

- An Investment Odyssey: Index Funds vs. Active Funds

- Understanding the After-Tax Effect: The Hidden Truth

- The Allure of Index Funds: A Beacon of After-Tax Returns

- The Active Funds Quandary: A Taxman's Paradise?

- Steering the After-Tax Wheel: Navigational Tips for Investors

- The After-Tax Chronicles of Index vs Active Funds

An Investment Odyssey: Index Funds vs. Active Funds

Investing is often framed as an epic battle – a long, winding journey where various players vie for the ultimate prize: your financial security and growth. Among the most prominent figures in this saga are the stalwarts – Index Funds and their rivals, Active Funds.

The Passive Guardians: Embracing the Market’s Pulse

Index funds, the modern heroes of the ‘passive’ movement, are built on the simple yet powerful principle of market-mimicking. They are the embodiments of a less-interventionist investment strategy, anchoring themselves to the performance of a broad market index, like the S&P 500. Their philosophy: Why fight the market’s wave when you can ride it?

The Active Seekers: The Tactical Touch

On the other side, with their battle-hardened managers, active funds operate on a more interventionist philosophy. They see the market not as a wave but as a sea of opportunities to be navigated with wit, insight, and research. Their goal is to outperform benchmarks by making shrewd investment decisions and attempting to leverage predictive methodologies and tactical movements.

Understanding the After-Tax Effect: The Hidden Truth

As investors, we are acutely aware of the pre-tax numbers – the headline figures that adorn investment reports and glossy marketing materials. However, the after-tax effect on these returns provides a much more accurate picture of the actual gains that we get to pocket after the government’s share is secured.

A Taxing Journey from Gain to ‘Net’

For the uninitiated, the after-tax effect is the difference in an investment’s pre-tax return and its after-tax return, influenced by the timing of buy and sell decisions, investment structure, tax-loss harvesting, and the tax policies of the jurisdiction. This disparity can be substantial, often leading to diminished returns. Jeff Bezos potentially left Washington state to avoid a 7% capital gains tax.

The Numbers Don’t Lie: Results from the SPIVA After-Tax Scorecard

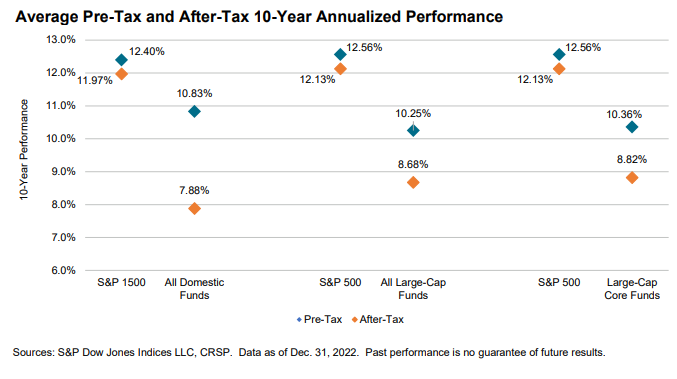

Diving into the SPIVA scores, we unearth a kind of financial astrology – patterns that, while unique to their respective investment constellations, mirror each other in the stark trends they reveal. Over one-, three-, five-, ten-, fifteen-, and twenty-year periods studied, the added effect of taxes resulted in significantly higher rates of active fund underperformance on an after-tax versus pre-tax basis – a testament to the potent role taxes play in our investment narratives.

The Allure of Index Funds: A Beacon of After-Tax Returns

The data pivots undeniably towards the stability and reliability of index funds, particularly concerning the after-tax horizon.

Charting the Tax-Starved Horizons

Index funds, crafted with a buy-and-hold ethos, boast low turnover ratios and a tax-efficient strategy that sees them distributing fewer taxable events to their shareholders.

From Theory to Triumph: The After-Tax Champions

Index funds often come out on top when translated into after-tax returns.

The Active Funds Quandary: A Taxman’s Paradise?

The story of active funds in the after-tax landscape paints a more nuanced – and at times, less flattering – picture.

The Tax-Time Toll: Active Funds and Their Capricious Consequences

With their propensity for turnover and potential capital gains distribution, active funds become an unwitting vehicle for triggering taxable events in the portfolio, leading to reduced after-tax returns.

A Prohibition of Profits? The SPIVA Verdict on Actives

Data seeped from SPIVA reports implies that, even in rare instances where active funds have managed to eke out pre-tax victories, the after-tax outcome sees these profits dampened, leading to a less-than-optimal after-tax reality for investors.

Steering the After-Tax Wheel: Navigational Tips for Investors

As with any financial voyage, success often hinges on the strategic acumen of the investor. When it comes to the after-tax impact, several considerations warrant contemplation.

Know Thyself: Assessing Your After-Tax Risk Profile

Every investor’s tax situation is as unique as a fingerprint, necessitating a bespoke approach to investment planning. It pays dividends (pun intended) to introspect about your financial preferences and tax standing before casting your lot in the investing world.

Balancing Act: Investment Goals vis-à-vis Tax-Efficiency

Investment goals are the North Star for decision-making. Ensuring that your portfolio is not just growth-oriented but also tax-efficient is the conjuring of a strategy that balances aspirations with realities.

Navigating the Fiscal Strait: Consulting with Financial Guiding Stars

The intricate dance between investments and taxes often demands a sage counsel. Financial advisors, with their expertise and market fluency, can act as Sherpas, leading you up the after-tax mountain with confidence and clarity.

The After-Tax Chronicles of Index vs Active Funds

The divide between the after-tax stories of index funds and active funds is not merely academic; it’s manifest in the wallets and well-being of investors. The roadmap to better after-tax returns is replete with signposts heralding the efficacy of index funds, and while the allure of active funds may still hold sway, the data compels us to give a standing ovation to tax-efficient investing.

For the contemporary investor, the after-tax realm is not a mere footnote; it’s the final chapter in the book of investment wisdom, signifying the seamless blend of optimism and pragmatism. As you anchor your investment portfolio in either the soaring indexes or the narrative-laden actives, consider this: The treasure at the end of the investment rainbow is, after all, a net gain. More than ever, understanding the after-tax effect is tantamount to weathering the market storm and emerging not just victorious but enriched – both financially and intellectually.